At the end of 2022, Ukraine’s allies established a price cap regime for Russian crude exports, aimed at limiting and controlling Russian revenues. The enforcement mechanism for this regime is designed to ensure that Russia should not be able to charter or insure oil tankers unless the sale is in compliance with the price cap. This article looks at the effects of the price cap on the composition of the tanker fleet serving the Russian oil trade.

Russia has chosen to defy the price cap by sourcing tankers and auxiliary services outside of the Western coalition. These tankers, which supposedly knowingly operate in defiance of Western sanctions, have been nicknamed the “shadow fleet.” The prevailing assumption today is that most if not all of Russian oil transported by sea is being sold outside of the price cap regime. Some of it is still carried by vessels owned by shipowners and/or insured by insurers that are subject to the price cap coalition legislation. This is most likely organized through lodging documents, perhaps even stamped by Russian customs offices, that vouch for the load’s sale price not exceeding the price cap. It’s also likely that the parties involved have at least some understanding that the reality may be very different. In that sense, there is little reason to distinguish between the various shades of gray when it comes to the ships serving the Russian oil trade in 2024. This article therefore looks at the entire population of vessels that served the Russian oil trade in the first nine months of 2024, and compares it with the rest of the global oil fleet and its subsets for the same period.

The article covers 2,849 oil tankers, of which 735 picked up at least one cargo in a Russian port this year, and is based on data collected via the ships’ automatic identification systems, which can be accessed via many ship tracking services. The vessels carried an average of 48 million barrels of oil per day (the rest most likely traveled via pipelines to the refineries).

Oil trading and shipping is a cutthroat business with relatively small margins—at least when times are quiet and boring. Companies engaged in it are accustomed to fulfilling regulatory requirements, but rarely go above and beyond that, mindful of profits and costs. The choice of vessel is a delicate balance between risk, reward, and regulatory obligations, which vary from market to market, so comparisons must take into account varying circumstances.

Before diving into the demographics of the tanker fleet, it is useful to establish some benchmarks.

What is the General Standard of “Old” and “Young” in Modern Seafaring?

Other articles discussing the shadow fleet have tended to imply that ships older than fifteen years are barely seaworthy, and are at high risk of an accident. It is worth looking at the demographics of other fleets that do not have to factor in politics or the desire to circumvent sanctions.

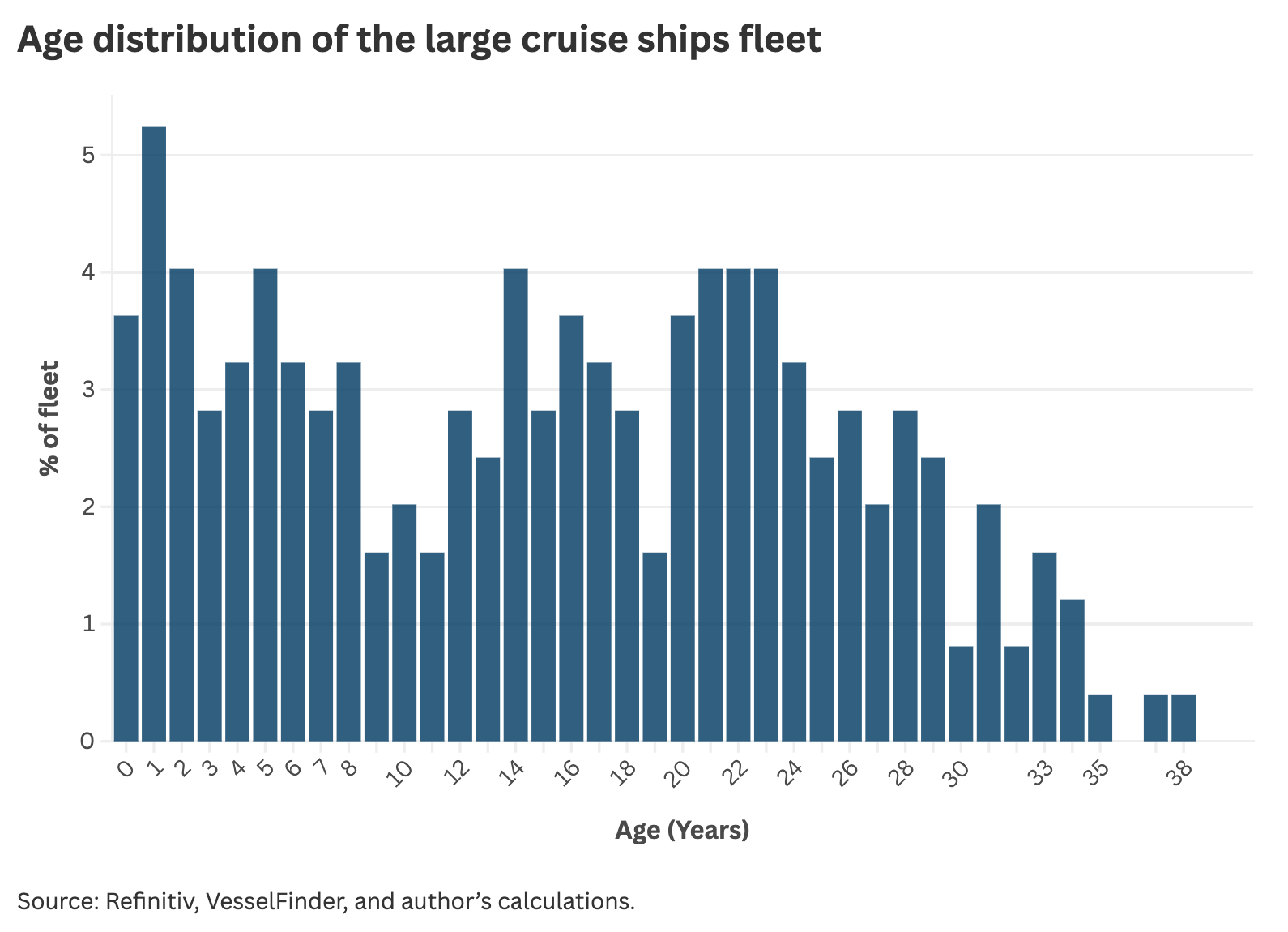

Large cruise ships can be taken as a relevant reference point, since they carry a high value load—people—and their discerning customers demand a high level of safety. In 2024 there were 250 large cruise ships (those with gross tonnage of more than 50,000 tons). The smallest of these ships are 220 meters long by 30 meters wide, which is similar to the ubiquitous Panamax tankers, while the largest are comparable in size to Suezmax tankers.

This histogram suggests that twenty is in fact more akin to middle age for a cruise ship than a mandatory retirement age. Since tankers are much simpler vessels than cruise ships, it is hard to identify a factor that would cause their accelerated degradation.

Does a Tanker’s Age Contribute to Oil Spills?

There could be commercial and operational reasons for tanker owners to decide to scrap their ships early, while cruise ship owners might want to keep their ships going for longer.

What matters to the public and policymakers is whether a ship’s age is a strong predictor of increased chances of an accident: in the case of a tanker, an oil spill. It is therefore useful to check for statistical measures to that effect.

ITOPF, the industry body devoted to the safety of marine oil transportation, has compiled statistics on oil spills of all sizes going back to the 1970s. According to ITOPF, the number of oil spills from tankers larger than 7 tons has not exceeded single digits per annum for the last fifteen years. This is a global tracking system that keeps tabs not only on accidents in the waters of richer countries, but also in less developed regions mostly served by older fleets.

Since 2000, there have been only three major oil spills, and fifty-five large spills (classified as those over 5,000 barrels).

Ironically, the tankers involved in the last two major accidents—Hebei Spirit and Sanchi—were fourteen and ten years old: relatively young by the metrics for the tanker fleet.

The safety record shows that despite the presence of many older vessels in the global tanker fleet, the number and volume of oil spills in the last decade and a half has been extremely low, so the age of the tankers—at least within the observable window of under thirty years old—has little influence on the probability and gravity of the accidents.

With a little more clarity on the metrics of “old” vs. “not old” when it comes to marine vessels, and a better understanding of the scale and frequency of the oil spills, we can turn to the demographics of the global crude tankers fleet.

Do Russia and Other Pariah Nations Have a Dedicated Fleet?

Are there separate fleets serving Russia, Iran, and Venezuela?

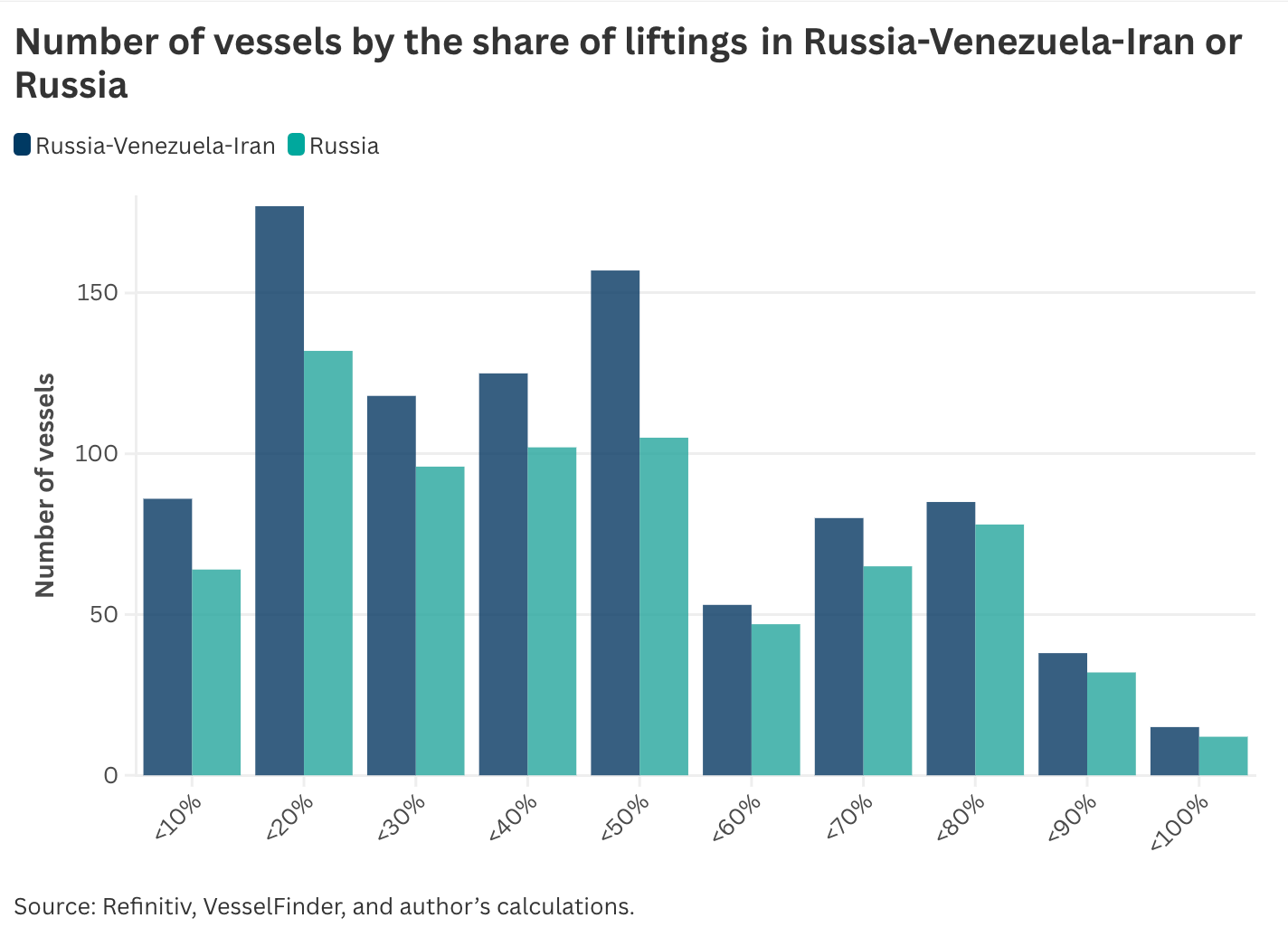

Hardly any ships engaged in the international transportation of crude oil dedicate all of their capacity to Russia, Iran, or Venezuela, either jointly as a group of countries, or separately. There was also very little overlap between the three countries: vessels were more likely to pick up additional business from other countries than from inside this group.

Much of these countries’ crude transportation business is handled by ships that work for them part-time or only occasionally. For the most part, this fleet is just a subset of the global tanker fleet: the “shadow fleet” designation is not very distinctive.

The Demographics of the “Shadow Fleet”

All of the charts below are histograms showing the percentage of barrels of oil that traveled from or to various countries on vessels of a certain age, with age on the horizontal axis and percentage on the vertical.

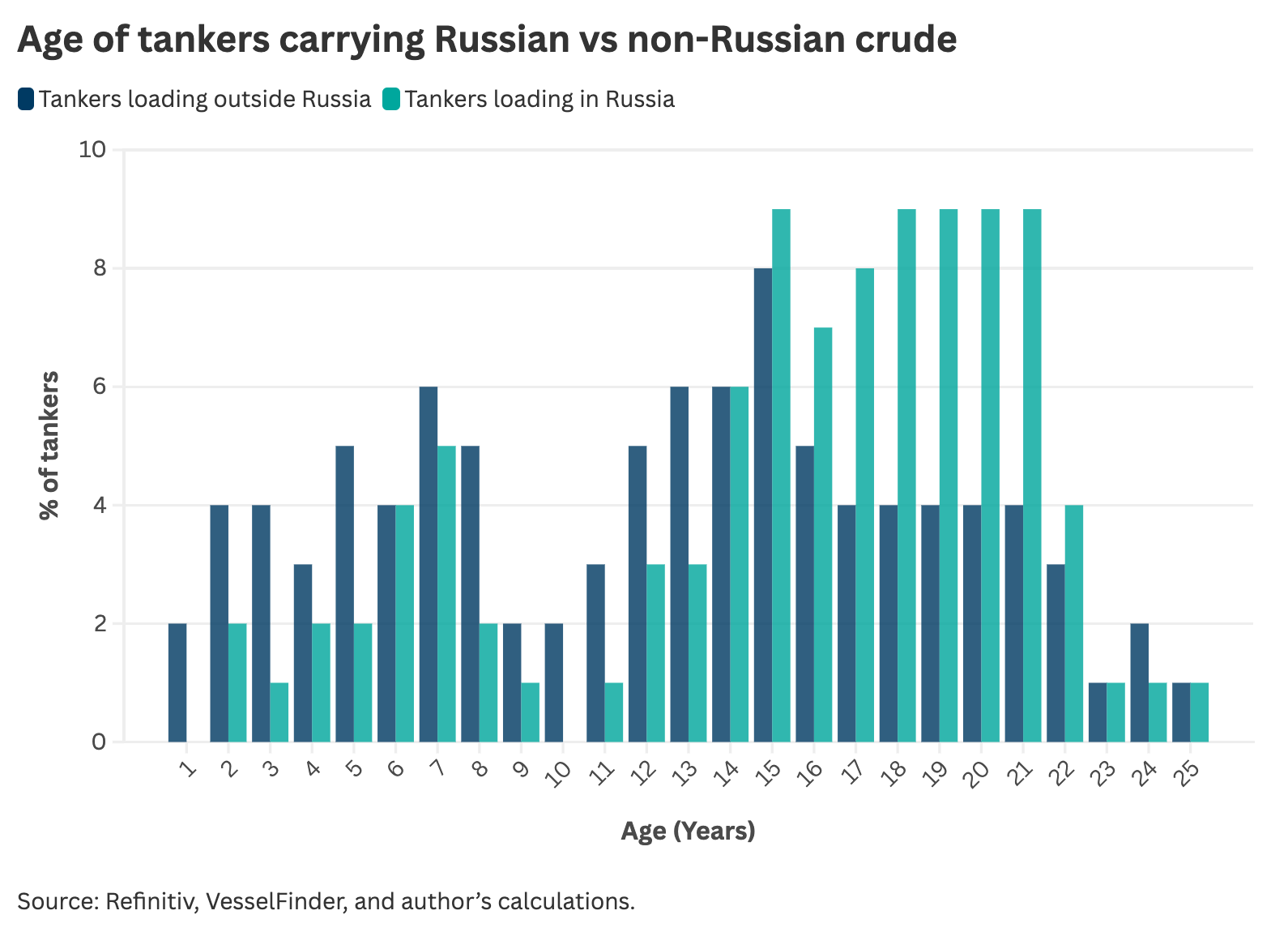

Even the most general comparison shows Russia’s (forced) “preference” for older vessels. There is a substantial overlap in the subgroups: very few tankers served Russia exclusively, and most of them picked up cargoes in both Russian and non-Russian ports. A quarter of the global tanker fleet picked up at least one cargo in Russian ports.

The difference in the median age of the groups is not drastic: thirteen versus sixteen years.

How Does the Age of the Russian Fleet Compare to the Fleet Carrying the Oil of Other Major Oil-Exporting Countries?

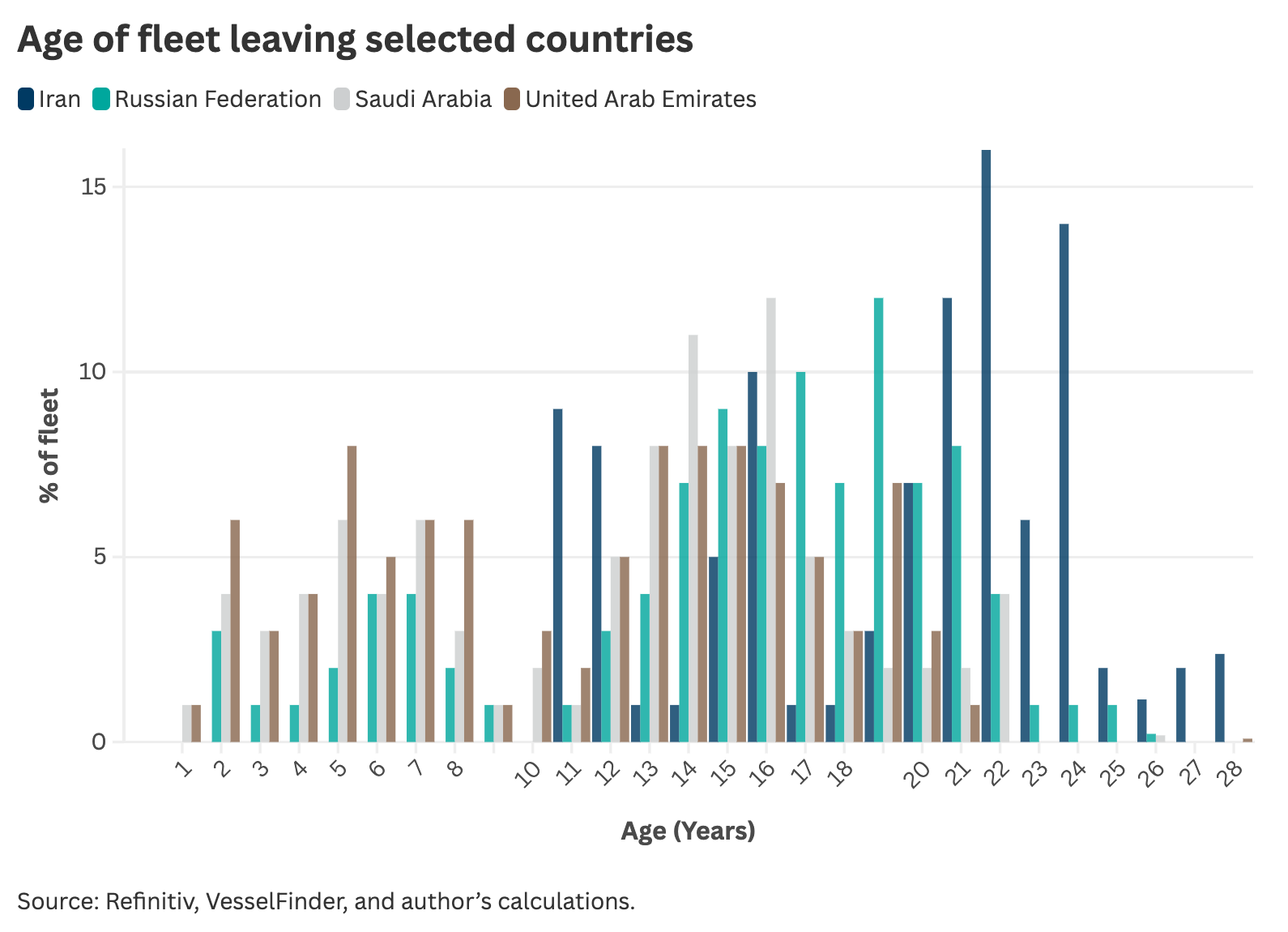

This article uses as a point of reference the fleet composition of two other major oil exporters, Saudi Arabia and the United Arab Emirates, as well as that of Iran, which has been subject to sanctions for many years and has been engaging in sanctions evasion.

The Russian fleet is on average three to four years older than the fleets that serve the two Arab countries. That’s not a drastic difference, and, furthermore, both countries employ a large number of tankers that are older than most of the Russian fleet. Interestingly, Iran does not use any tankers younger than ten years old, and its two largest cohorts are twenty-two and twenty-four years old, while Russia’s vessels are mostly under twenty years old.

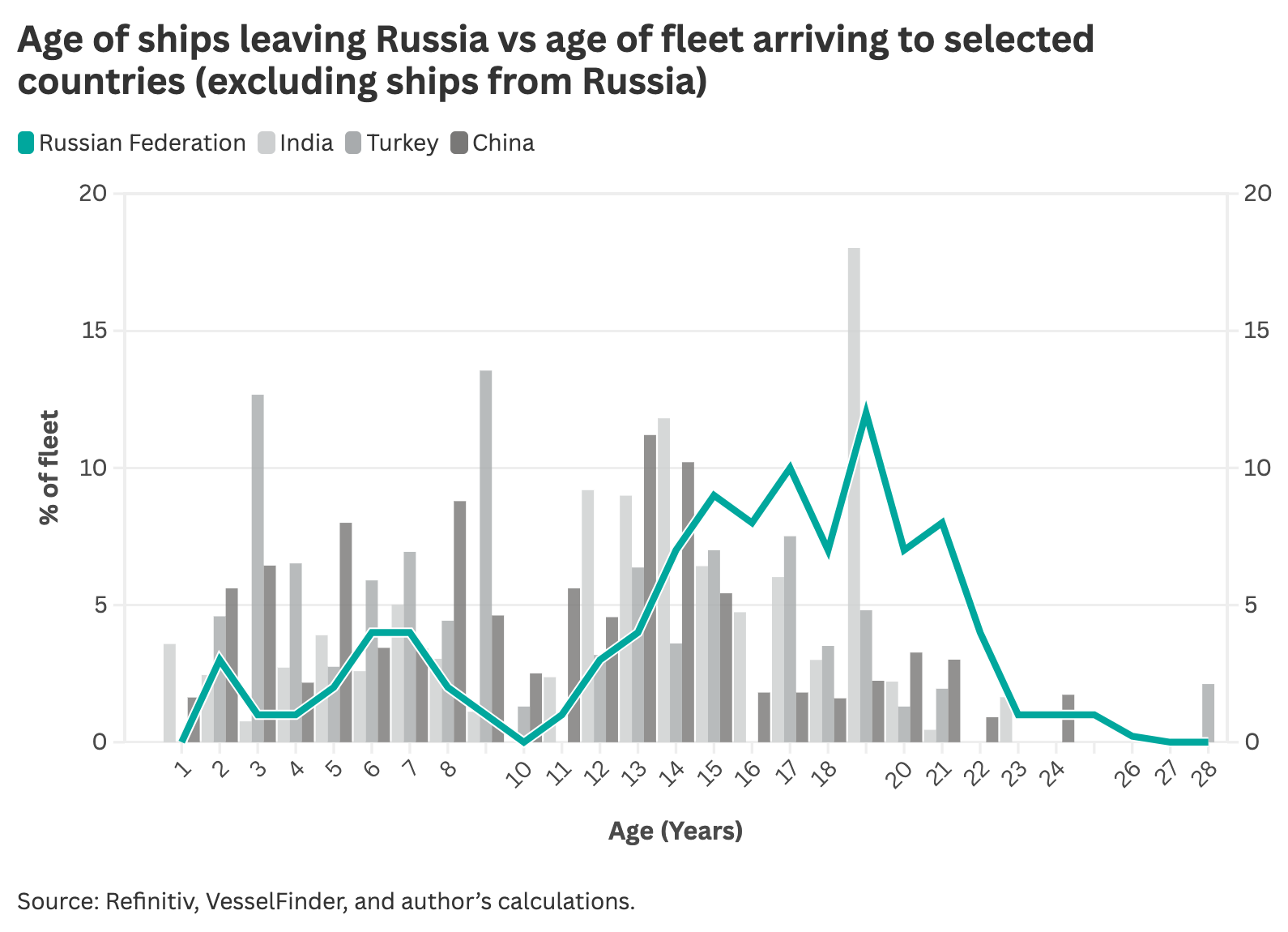

How Does the Age of This Fleet Compare to That of the Ships Bringing Oil to Major Non-Western Buyers of Russian Oil?

Since 2022, Russia has pivoted its oil exports away from Europe, where many major oil-trading hubs do not allow any ships older than twenty years old, to Asian markets with less stringent requirements. The composition of the Russian tanker fleet seems to be getting close to the Indian standard, which could be skewed by the large number of deliveries that India receives from Iran.

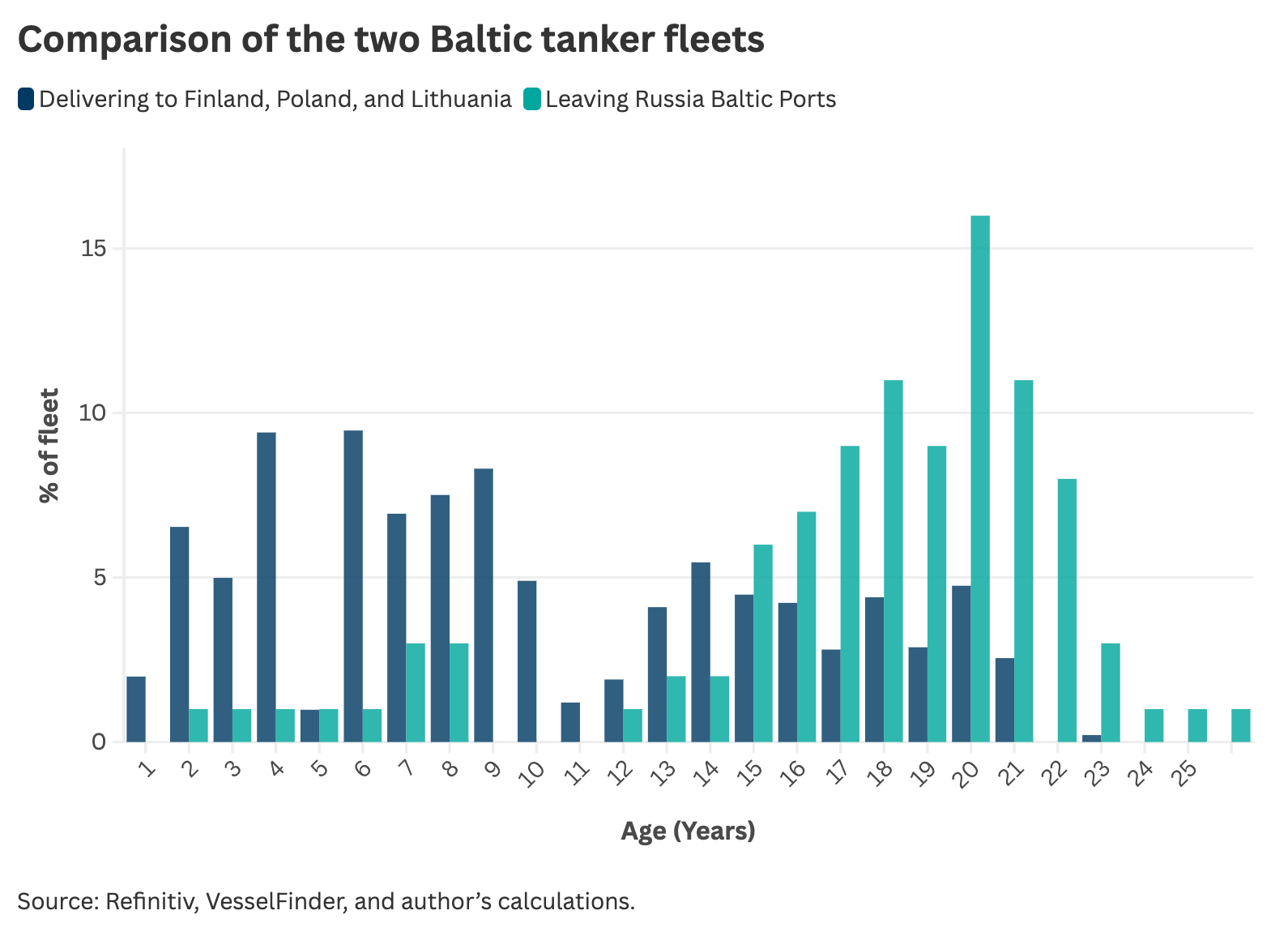

What About the Baltic Sea and the Danish Straits?

There is an additional focus on older Russian tankers passing through the Danish straits, with calls and suggestions to ban or limit that transport on environmental grounds. At the same time, there is substantial tanker traffic carrying non-Russian oil in the reverse direction, serving refineries in Finland, Lithuania, Poland, and Germany (via Gdansk). It is interesting to compare the composition of these two fleets:

The Russian fleet is certainly older than that serving EU refineries, but there is also a surprising number of vessels aged about twenty years old that are delivering non-Russian oil to the countries on the Baltic Sea, while at the same time there is a noticeable number of younger ships in the Russian fleet. Half of all the vessels delivering non-Russian crude to Baltic refineries are nine years old or younger, while 15 percent are seventeen years old or older.

The data show that Russia employs a relatively old fleet to sell its crude around the world. This may be a conscious strategic choice: ships participating in sanctions-violating activities run the risk of being singled out by the U.S. Office of Foreign Assets Control, which enforces sanctions, and other forms of exemplary punishment, which would limit their use and force the owner to scrap the vessel. Faced with this threat, the rational strategy is to employ ships with low residual value in order to limit the potential losses.

On the other hand, the fleet serving Russia is not drastically older than that which serves the rest of the world, and there are many ships employed by reputable oil sellers and buyers that are of the same age as or older than those serving the Russian oil trade. With a quarter of the global tanker fleet transporting Russian cargo in 2024, the so-called “shadow fleet” is neither as separate nor as obscure as might have been thought.