Following Russia’s full-scale invasion of Ukraine last year, imports of many essential items for the IT sector swiftly dried up, including deliveries by all major Western IT companies and other international firms. While processors and other component parts for client computers are still largely available on the Russian market, equipment for servers has become much harder to source.

Even parallel imports—a government scheme allowing Russian retailers to import products from abroad without the trademark owner’s permission—are unlikely to be able to solve the country’s growing computing power deficit. The chances of Russian producers being able to fill the gap in the market are slim, even over time.

There are just two companies in Russia making processors that can be used in both client devices and in servers. The first is MCST, which uses both its own Elbrus processor architecture and the international SPARC architecture created in the 1980s by Sun Microsystems. Elbrus also supports a binary translation mode that allows it to run software developed for x86 and x86-64 architecture, meaning it is compatible with software running on processors produced by the U.S. companies Intel Corp and Advanced Micro Devices Inc (AMD).

The second Russian company is Baikal Electronics, which makes processors based on the ARM architecture. The Baikal-M series is designed for client devices, while the Baikal-S series is for servers.

The Western sanctions dealt a major blow to the Russian processor manufacturers, as both MCST and Baikal Electronics worked closely with Taiwan Semiconductor Manufacturing Company (TSMC) and its factory in the Taiwanese city of Hsinchu. Using 28 nanometer (nm) technology, they made almost all of MCST and Baikal’s processors.

Taiwan was also chosen to make Baikal’s S1000 processors, using more modern 16nm technology. But mass production never began, and there is a large question mark over Baikal’s next-generation processors, which were originally expected to reach the market in 2023–2025.

There are other design centers in Russia apart from MCST and Baikal Electronics, but they are more limited. Sintakor, for example, produces IP blocks that other companies can license and use in their products, rather than making finished processors. There is also MultiClet, Milandr, and KM211, but a modern, high-performance server cannot be built using their products.

The cooperation between Russian companies and Taiwanese TSMC, as well as other foreign firms (for example, Taiwan’s UMC, GlobalFoundries in the United States, and Germany’s X-Fab), was born of historical necessity. Not only was the Soviet semiconductor industry lagging behind the West’s when the Soviet Union fell apart, many firms and design centers ended up outside of Russia (for example, Kyiv’s microelectronics research institute; the Rodon factory in Ivano-Frankivsk, Ukraine; and Integral in Minsk, Belarus). Those that were left inside Russia quickly stagnated or closed down.

While there are some survivors from the Soviet period, like Mikron Group, they have limited capabilities. In short, the production capacity that exists in Russia today is not enough to make modern, high-performance processors for general use that are capable of replacing the server processors of AMD and Intel. Russian semiconductor factories are only able to make microcontrollers, specialized processors for the military and industry, and some other products.

One of the main problems is that foreign-made equipment was used to produce microchips. This is a vulnerability that Western sanctions have targeted.

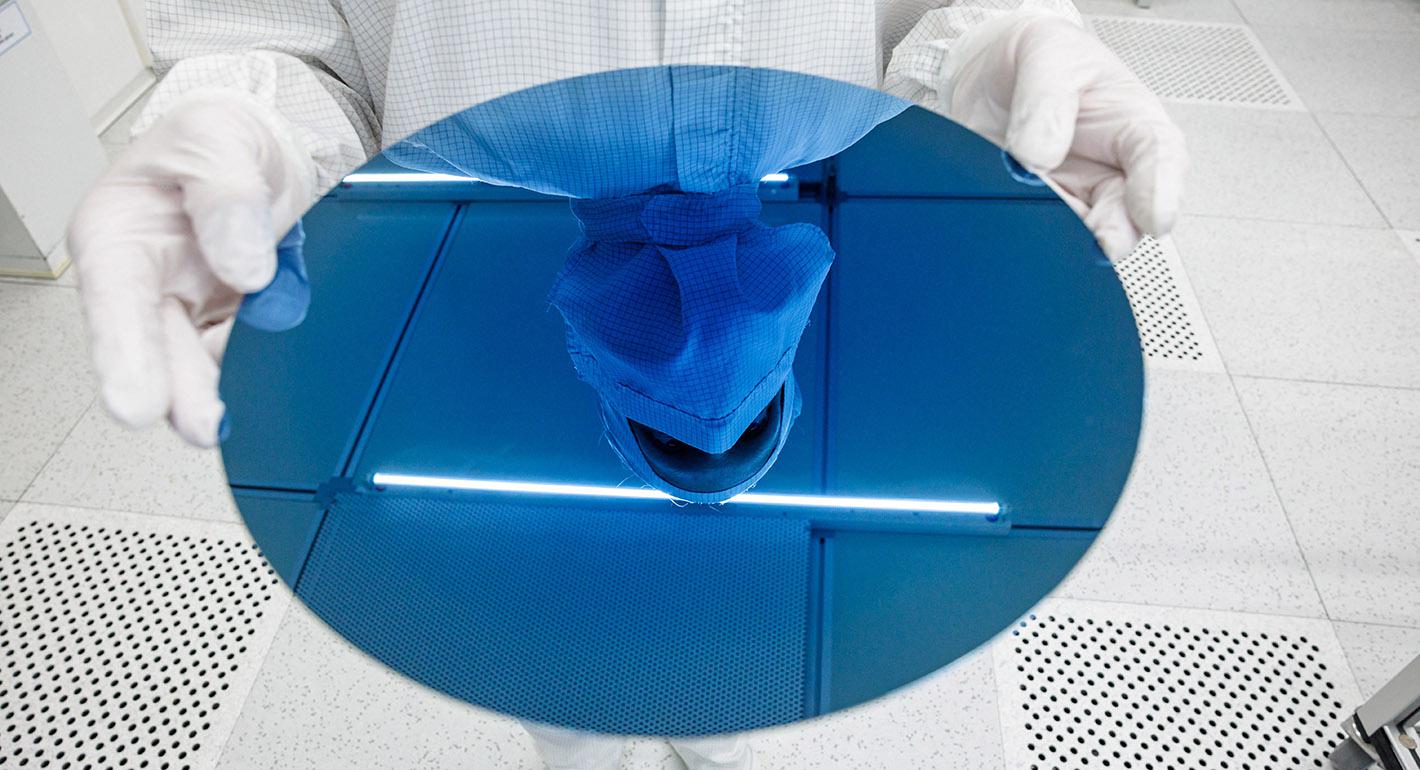

For example, restrictions imposed by the United States on Russian electronics manufacturer Angstrem in 2016 made product servicing much harder. The same is true for some of the materials required for production, such as the polycrystalline silicon wafers used in photolithography. At the start of 2023, state defense conglomerate Rostec announced it was preparing to start the production of 150mm and 200mm silicon wafers, but it’s still not clear when this will actually get under way. Import substitution, it turns out, is not an easy process.

As a result, Western sanctions have had a major impact on Russian semiconductor production. Almost immediately after the invasion of Ukraine, TSMC halted supplies of finished products to its Russian partners. In June 2022, Taiwan officially introduced limits on semiconductor exports to Russia.

In particular, Taiwanese companies can no longer export chips that have clock frequency rates above 25MHz, ICs with more than 144 pins, or an arithmetic logic unit with an access width of 32 bits or more. Almost all modern processors are affected by these restrictions, including those developed by MCST and Baikal Electronics.

It’s not easy for Russian companies to find new production partners. In February 2022, the United States banned the export to Russia of semiconductors produced with U.S. equipment or intellectual property. Anyone violating these rules can be hit with secondary sanctions.

There are no exceptions, and even companies in friendly countries have had to think long and hard about whether to work with Russian firms. In March 2022, Gina Raimondo, the U.S. secretary of commerce, threatened to essentially shut down China’s Semiconductor Manufacturing International Corporation if it sent products to Russia.

In October, Washington banned U.S. companies and nationals from helping Chinese semiconductor companies to produce 16nm chips and anything more advanced. Similar rules were introduced by Japan and the Netherlands, the world’s main photolithography equipment producers.

If Chinese companies violate the sanctions on semiconductor exports to Russia, the United States could impose new restrictions on them, including by targeting so-called mature technology of 16nm and above. Given the experience of the Chinese company Huawei, which has for all intents and purposes been cut off from both key technologies and its sales market by U.S. sanctions, it seems likely that other Chinese firms will observe the sanctions.

Even if Russian microprocessor developers manage to find partners prepared to produce chips, establishing new production lines will take a lot of time and money. The processes at tech factories vary, and each producer has its own design rules and standards. In other words, if a chip is designed to TSMC’s specifications, then switching it over to a different producer will only be marginally easier than developing a new chip from scratch.

Baikal Electronics has been faced with another serious problem for which it doesn’t yet have a solution. While MCST developed processors using its own architecture, Baikal Electronics used ARM architecture, for which it needed a license. In May 2022, Baikal Electronics was sanctioned by the United Kingdom, which means that local companies (like ARM) are banned from providing services to it or receiving payments from it.

The UK government’s decision does not mean the recall of existing licenses (such as those issued for the production of Baikal-M and Baikal-S processors), but no more will be forthcoming. This will affect next-generation chips like Baikal-L, Baikal-M2, and Baikal-S2. It’s extremely unlikely that any company in the world would agree to produce them, as this would be a patent infringement.

All this suggests that for the foreseeable future, Russia will not be able to replace the microprocessors it once freely imported. And that means the computing power available to Russian companies and state agencies will continue to decrease.