Registration

You will receive an email confirming your registration.

As the United States and China engage in escalating trade actions and U.S.-Turkey tensions drive a currency and debt crisis in Istanbul, the global trade order is under strain. While the international community focuses its attention on trade, issues related to global production networks and flows of capital are essential to the discussion, which means monetary, investment, and fiscal policy must also be considered.

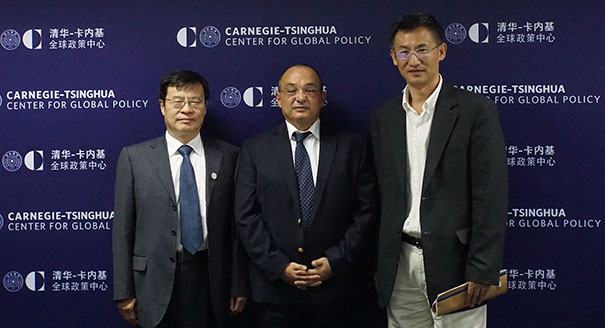

Shi Zhiqin moderated a roundtable event with Emilios Avgouleas and Ju Jiandong that addressed the vulnerabilities of the global economy to trade disputes and financial deregulation to provide insights into how the interplay of trade, monetary, investment, and fiscal policies shape the global economic system. The speakers also assessed frameworks for global policy reforms within regional and international structures.

This event was off the record and held in English.

DISCUSSION HIGHLIGHTS

- The Intermingling of Trade, Monetary, and Fiscal Policy: Panelists discussed how it is no longer feasible to separate trade, monetary and fiscal policy, as they are now basically integrated in the global economic system. Because of this overlap, global markets are more and more vulnerable to regional banking crises. While global agencies like the Financial Stability Board and the International Organization of Securities Commissions (IOSCO) provide some international regulations, they are largely “soft law” organizations that cannot function without the consent of the global economic community. Therefore, panelists argued, it is increasingly difficult to guard against international economic shocks.

- A Multipolar Economic System: The discussants noted that it is necessary to stabilize the international economic system while further integrating trade, monetary, and fiscal policy. Arguing that the world would not be willing to return to a Bretton Woods system where the United States makes the most important decisions, the panelists said that creating a multipolar economic system should be a priority. They also mentioned that, since the United States and China are in the midst of a trade war, it is increasingly unlikely that great powers will work together to solve economic problems, making a multipolar system a fairer, better option for the global community.

- The Global Unit of Account: The panelists also discussed the need for a Global Unit of Account (GUOA) that would standardize and measure the rate of global GDP growth or decline, the volatility of global commodity and energy prices, and the volatility of the key global stock market indices. One panelist argued that the GUOA would curb speculation and currency manipulation. Furthermore, the GUOA would be impossible to manipulate, would incorporate flexibility and allow for some uncertainty in currency valuation, and would not be pegged to vague concepts like purchasing power. The GUOA could be included in revisions of IMF articles, WTO treaties, or as a binding element in regional trade agreements.

Shi Zhiqin

Shi Zhiqin is a professor of International Relations at Tsinghua University and resident scholar at the Carnegie-Tsinghua Center for Global Policy, where he runs the China-EU Relations program and the China-NATO dialogue series. He is the executive director of the Belt and Road Strategy Institute at Tsinghua University.

Emilios Avgouleas

Emilios Avgouleas holds the International Banking Law & Finance chair at the University of Edinburgh. He is a member of the Stakeholder Group of the European Banking Authority (EBA) and an independent member of the Euro-working group select panel for the Hellenic Financial Stability Fund.

Ju Jiandong

Ju Jiandong is the Unigroup Chair professor at the People’s Bank of China School of Finance at Tsinghua University and a Chang Jiang scholar at the Chinese Ministry of Education.