July 2024

Dear Friends,

The annual African Growth and Opportunity Act (AGOA) Forum recently concluded, with implications for the trade program’s significance and future. On July 23, I attended the AGOA Private Sector Forum hosted by the Corporate Council on Africa. In my remarks as part of a “Beyond AGOA” session, I emphasized the need for AGOA to support a productive trade relationship between the U.S. and Africa that advances both African industrialization and U.S. strategic objectives. Africa Program fellow Jane Munga moderated a breakout session on “Accelerating Africa’s Digital Technology and Service Exports to the United States” that discussed how African businesses and governments can leverage initiatives like the Digital Transformation with Africa (DTA) and AGOA to increase digital technology and service exports to the U.S. and boost digitalization and digital trade in Africa. Much of the discussion at the AGOA Forum centered on how it can best be modernized for a new era of U.S.-Africa economic partnership.

In April, U.S. Senators Jim Risch (R-ID) and Chris Coons (D-DE) introduced the AGOA Renewal and Improvement Act of 2024, which would extend AGOA by sixteen years, moving its expiration date to 2041. In the context of the reauthorization effort, there is growing momentum around various elements that could be incorporated into an enhanced AGOA bill, especially using the trade program to secure U.S. “critical” minerals supplies. On July 23, in advance of the 2024 AGOA Forum, we hosted the honorable South African Minister of Trade, Industry and Competition Parks Tau for a private roundtable discussion with government, industry, labor, and civil society representatives, as well as policy experts and academics. The South African delegation communicated that its new government of national unity was undertaking a national political and economic reset, which it hopes would be the basis of domestic economic rejuvenation, a revitalized relationship with the private sector, a springboard for a more stable U.S.-South Africa relationship and the South African government’s global trade priorities. Nonresident scholar Tony Carroll’s opinion piece in the Daily Maverick details how South Africa, led by Minister Parks Tau, is seeking to reset its relationship with the United States after some diplomatic stumbles.

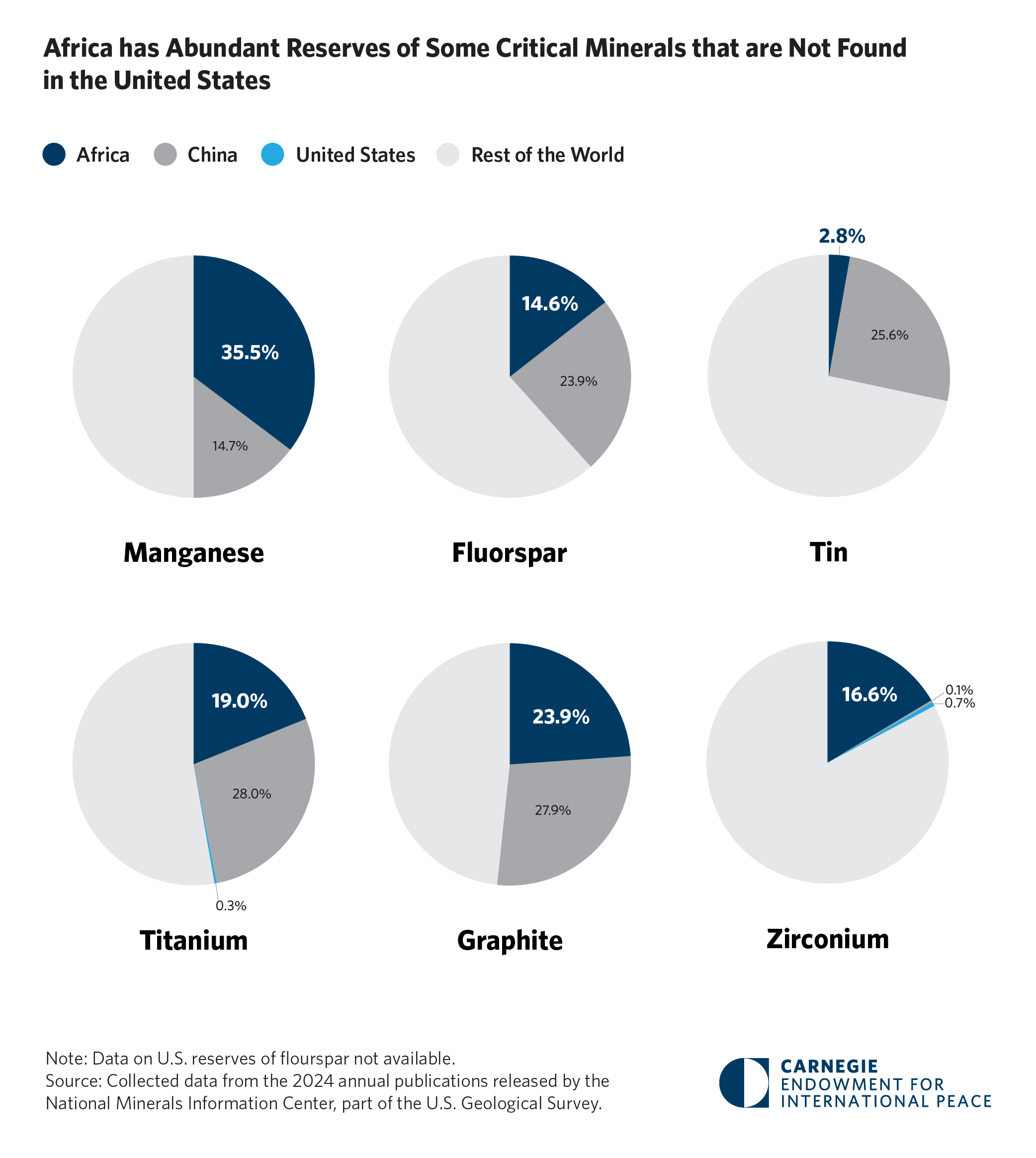

Our recent policy outlook details how a reauthorization of AGOA, along with the subsequent expansion of U.S.-Africa trade in “critical” minerals, could be mutually beneficial for all involved parties. We consider three options for how the ongoing AGOA reauthorization effort could facilitate increased African participation in U.S. clean energy supply chains. First, the exemption of eligible African mineral producers from the Inflation Reduction Act (IRA) restrictions. Second, to reframe the U.S.-Africa trade relationship into a strategic economic partnership for the new era. And third, to negotiate a new “critical ” minerals agreement. Our Chart of the Month, below, taken from the policy outlook, showcases Africa’s abundant reserves of minerals critical to the United States’ clean energy transition.

On our radar this month is the political crisis in Kenya. Since June, Kenya has been rocked by mass protests that were initially against the government’s announcement of a new finance bill that would increase taxes by $2.7 billion and expanded in scope to challenge corruption and lack of government accountability. Proposed provisions, included a 16 percent sales tax on bread and a 25 percent duty on cooking oil, led to backlash among Kenyans who face an already high cost of living. The domestic political crisis is happening just as the international profile of Kenya’s president, William Ruto, was rising. In fact, the protests began exactly a month after Ruto’s state visit to Washington, the first for an African leader in sixteen years and the third ever by a Kenyan president – a historic foreign policy moment. Africa Program scholar, Jane Munga, examined some of the announcements associated with the visit, particularly the U.S.-Kenya digital commitment, which expands on the Digital Transformation with Africa initiative (DTA).

However, Ruto’s growing international profile – including in Washington, D.C. – belies his domestic unpopularity and the challenges he has faced in executing his policy agenda. In attempting to respond to the protesters demands, the Kenyan leader announced on June 26 that he would not sign the finance bill, announced $1.39 billion cuts to government expenditure, sacked his entire cabinet, and subsequently appointed a new cabinet including members of the opposition’s Orange Democratic Movement. Protests have continued, and the key question around how to address Kenya’s $82-billion debt burden and its fiscal deficit – which was the reason for introducing the rejected legislation – remains unresolved.

Over on the continent’s western coast in Nigeria, months of brewing tensions between billionaire Aliko Dangote and the Nigeria government have erupted into a full-blown faceoff with implications for the country’s energy security and foreign exchange challenges. For context, Aliko Dangote is Africa’s richest man, the world’s richest black man and chief executive officer of the industrial conglomerate Dangote Group. The Dangote Group recently completed and commissioned a $20 billion petroleum refinery complex, one of the largest in the world, which in theory was meant to reduce Nigeria’s reliance on imported fuels (gasoline, diesel) for domestic consumption and thereby reduce pressures on the Naira. Nigeria’s currency has depreciated by nearly 80% against the U.S. dollar since the summer of 2023.

However, a refinery that was once regarded as a national champion now sits in the crosshairs of the Nigerian federal government, which has accused Dangote of “seeking a monopoly” through a ban on imported fuels. Back in June, the usually taciturn Dangote had criticized the Nigerian government’s economic policies that he described as creating an inhospitable business environment. He noted the country’s high interest rates (over 30%), absence of electric power and lack of direct support to the manufacturing sector in strategic industries through industrial policies that are now being implemented around the world. For context, around 15 multinational companies have exited the Nigerian market in the last three years, the economy is experiencing the highest inflation rate in nearly three decades (around 33% and food price inflation at over 40%), there is growing food insecurity, the economy is projected to slip to fourth place by year’s end, and mass protests are being planned around the country against the rising cost of living. We will continue to monitor how the rift between Dangote and the Nigerian federal government evolves.

Thank you, again, to everyone who joined us for our first ever Carnegie Africa Forum on June 27. Nearly 900 guests joined us in-person at the Woolly Mammoth Theater and online for a full day of panels, performances, and debates on topics including Africa’s role in the global energy transition, the consequences of changing geopolitical alignments for African nations, and the future of artificial intelligence on the continent. To play back the livestream of the event, head to our YouTube page here.

This is our last newsletter for the summer. We will be returning with program updates in September. Until then, have a wonderful summer!

Sincerely,

Zainab Usman

Director, Carnegie Africa Program

Chart of the Month

The Chart of the Month showcases the reserves of manganese, fluorspar, titanium, graphite, and zirconium that are found on the continent. It is taken from our recent policy outlook on how AGOA reauthorization could help facilitate the expansion of U.S.-Africa critical minerals trade.

The July 2024 Chart of the Month

Features

African countries are gaining greater representation at COP, but it is unclear whether this increased visibility will lead to better climate outcomes for the continent. Victoria Markiewicz, Praise P.T. Gandah, & Nicholas R. Micinski

Cooperation between Africa and Europe should build on both continents’ strengths to identify converging interests, compatible visions, and potential synergies. David McNair

Ruto’s state visit to Washington resulted in a historic foreign policy moment with technology cooperation at its core. Now, the Kenyan president has the enormous responsibility to capitalize on these opportunities. Jane Munga

South Africa's New Minister of Trade, Industry and Competition Parks Tau has made a compelling case that South Africa is seeking to reset its relationship with the United States, which has faltered during the past few years. Tony Carroll

Developments on Our Radar

- African Ministers Adopt Landmark Continental Artificial Intelligence Strategy, African Digital Compact to Drive Africa's Development and Inclusive Growth [African Union]

- Coup-hit Nations of Niger, Mali and Burkina Faso Form Sahel Alliance [Africanews]

- Kenya: Ruto Nominates Allies of Opposition Leader Odinga to Cabinet [Africanews]

- How Four U.S. Presidents Unleashed Economic Warfare Across the Globe [The Washington Post]

- COMESA-EAC-SADC Merger To Allow 14 Countries' Seamless Trading Within Tripartite FTA [The North Africa Post]